Auto Deleveraging

What is Auto Deleveraging (ADL)?

ADL is the last line of defence for the Globe liquidation system. When an account needs to be liquidated, the liquidation engine will slowly trade the account out of the positions it’s built up, until the account is either back above its maintenance margin requirement, or the position is completely wiped out. However sometimes in very illiquid markets, or markets that are experiencing high volatility, the liquidation engine is unable to complete successfully. Instead of leaving the account to continue building up potentially huge losses, our risk engine takes over and then forces a sale against more profitable positions - deleveraging the profitable position.

It’s important to note that this is a last resort - in normal circumstances on liquid products, the liquidation engine will be able to effectively trade out of a position without resorting to ADL.

How does it determine which positions to ADL?

When the risk engine determines ADL is required it ranks positions based on profitability and leverage, calculating an ADL Score.

where:

Every account with a position in that product is ranked, and the highest ranked position with the opposite side will be the first one chosen to ADL against.

How do you find out your ADL Ranking?

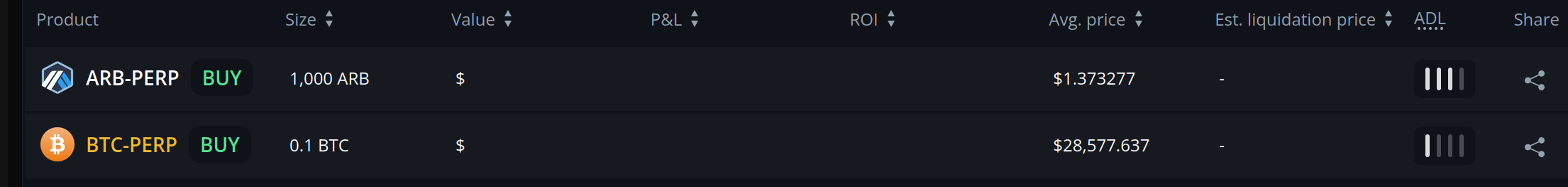

ADL scores and ranks change very rapidly with the mark price and trading activities, so we don’t expose it directly. Instead we divide the ranking into 4 quartiles, and give you which quartile you are in as a number from 1-4. We show this as an indicator on the right of your positions on the trading page.

How to manage your ADL risk

Your ADL score is a factor of your unrealised profit and your overall leverage across all positions. So there are two ways to reduce your ADL ranking - reduce your leverage, or reduce your unrealised profit percentage. There are a couple of subtle points to note that may help you here.

Globe has a cross margin system, which means it calculates leverage across all positions, not just separately. This means that reducing the leverage for one position affects all the others. So if you want to reduce your score on a particular position, but don't want to sell any, you can reduce leverage on another position instead. A word of warning: this works both ways, so if you increase the leverage on a different position, that will increase the ADL score.

Secondly, because ADL is based on unrealised profit percentage, you can reduce it by selling your position to realise the profit, and then reopening it at a different entry price. A few things to note about this. Firstly it only helps if your position is in profit. Secondly, as it's based on profit percentage, simply reducing your position won’t work - you would need to re-enter at a new entry price to change the percentage. Finally, there is the risk of slippage when selling a position and getting back in.

Ultimately it's up to you to consider how best to manage your own ADL risk.